Numerous pieces of research have shown growing interest among all age ranges in ethical and sustainable investments, as investors seek to reflect their values in their portfolios.

According to the annual Schroders Global Investor Study, 54 per cent of UK investors have increased their allocation to sustainable investment funds, compared with five years ago.

Of the 67 per cent of UK respondents who acknowledged that sustainable investing was more important to them now than it was five years ago, a significant proportion cited the potential for long-term returns as a greater factor than ethical considerations.

In other words, it has become more than a simple “box-ticking exercise”, as Schroders' Jessica Ground observes.

She tells FTAdviser: “Making sure you are focusing on the material issues and what the company is doing in practice is vital. To do ESG well in a way that helps investment returns, you have to be prepared to do fundamental analysis.”

The types of products available to investors has become increasingly sophisticated to meet this widening investor interest.

Andrew Howard, head of sustainable research at Schroders, explained: “The market is maturing through an exciting shift where the attention turns from ESG as a generic idea, to the specific details of how different organisations and products are approaching the topic.”

John David, head of Rathbone Greenbank Investments noted: “For those looking to use their money to make a positive difference to society, making ethical consumer choices or boycotting a company that contravenes their own personal beliefs may seem like the logical choice.

“But there are other ways of driving lasting change.”

He called for the sustainable and ethical investment community to do more to raise awareness of the choices available to investors.

Ellie Duncan is deputy content plus editor at FTAdviser

Clients increasingly seeking ethical investments

Advised clients are increasingly seeking ethical investments, particularly clients aged 25-34, research has suggested.

In a survey of 1,500 UK adults, carried out by Atomik Research and commissioned by Rathbone Greenbank Investments, 18 per cent of respondents wanted to put more ethical investments into their pension pots.

More than 23 per cent also said they would not like to invest in companies with whose business or conduct they disagreed.

John David, head of Rathbone Greenbank Investments, commented: "For those looking to use their money to make a positive difference to society, making ethical consumer choices or boycotting a company that contravenes their own personal beliefs may seem like the logical choice. But there are other ways of driving lasting change.

"What many consumers aren’t aware of is how ethical and sustainable investment can be a powerful tool in helping to shift the mindset and direction of a company."

He commented that initiatives such as Good Money Week could do "a great job" at increasing consumer awareness, but added that more needs to be done by the ethical and sustainable investment community to raise awareness of the choices available.

"Advisers, too, can play their part in promoting ethical choices among their clients," he added.

The research also showed a large generational divide in attitudes towards ethical investment, with those aged between 25-34 far more likely to get involved with social impact investing (at 36 per cent) than over 45s (at just 6 per cent).

Some 28 per cent of the 25-34 age group said that using shareholdings to impact a company’s activities positively was the best way to use money for good, again contrasting sharply with the 5 per cent of over 45s.

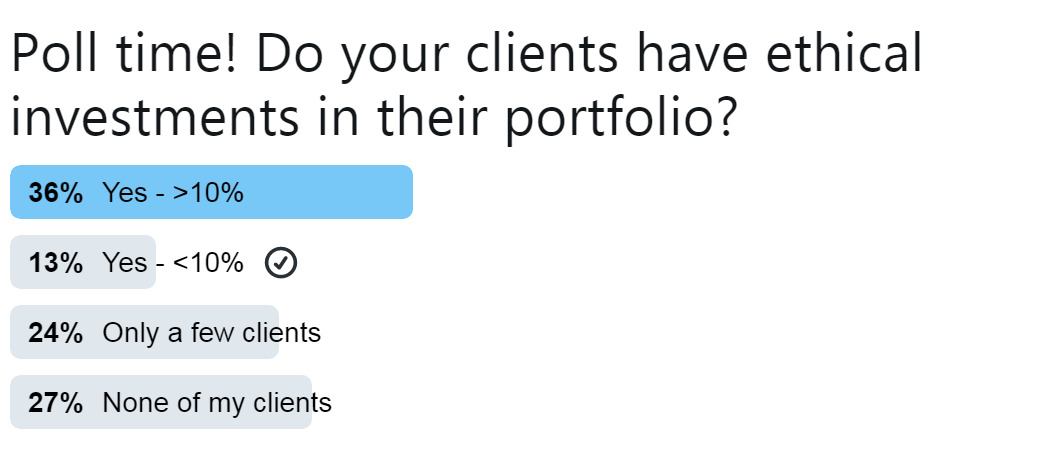

In a poll taken among financial advisers for FTAdviser Talking Point, 36 per cent of advisers said more than 10 per cent of their client base were already investing in ethical funds or in sustainable companies.

According to the poll, 13 per cent said less than 10 per cent of the client base was interested in ethical investments, while 27 per cent of advisers said their clients had no money at all in ethical investments.

What many consumers aren’t aware of is how ethical and sustainable investment can be a powerful tool

This comes as YouGov research for Good Money Week revealed that 47 per cent of UK adults said they wished their money to be invested with an element of making a positive difference.

Some 40 per cent wanted a fossil fuel-free option, up from 35 per cent last year and 32 per cent in 2015.

Moreover, 57 per cent of investors under 24 want to see fossil fuel free-fund options from financial advisers, but only 34 per cent of over 45s do.

As part of Good Money Week, the UK Sustainable Investment and Finance Association (UKSIF) also conducted research which showed 57 per cent of investors believed investment managers have a responsibility to ensure the companies they invest in on behalf of clients are managed in a ‘positive’ way.

simoney.kyriakou@ft.com

Companies taking ESG seriously are long-term winners

Inequality and climate change have created a challenging backdrop for companies, meaning a failure to incorporate these principles will provide a poor return for investors.

This claim was made by Jessica Ground, global head of stewardship for Schroders, who said it was vital to think about environmental, sustainable and governance (ESG) investing in terms of “risk and return”.

“We see it as the third dimension of investing. If you are going to be successful in allocating capital on a forward-looking way, then you are going to need to take ESG into account, and to hold these companies to account.”

According to data from the S&P 500, the average tenure of a company has fallen from 50 years to 15. This means that companies operating with a view to long-term sustainability will be those who last the course.

Ms Ground added it was “so important” investors do not just use a tick-box approach to ESG. She said: "Investors should focus on digging into the numbers and on the material issues.

“For example, it is less important if a newspaper has a climate change policy, but it is very important that a mining company has one.

“Making sure you are focusing on the material issues and what the company is doing in practice is vital. To do ESG well in a way that helps investment returns, you have to be prepared to do fundamental analysis.”

I know for a fact that companies which are managing these risks well do make better long-term investments

Ms Ground, who has more than 20 years' experience of investing, said it was clear firms operating on strong ESG principles make better long-term holdings.

“I know for a fact that companies which are managing these risks well do make better long-term investments,” she added.

This is as important for individual investors as it is for institutional investors, but at any level, engagement is crucial to help drive change, she said.

Ms Ground also told FTAdviser that Schroders is focusing in particular on seven of the 17 UN Sustainable Development Goals (SDGs), which are being implemented by 2030.

“For example, one of the goals is on bribery and corruption. We have been doing a lot of work globally to make sure the companies in which we invest have robust [anti-bribery and corruption] policies and are monitoring their business behaviour.

“We have a huge role to play in policy and encouraging better practices.”

Ms Ground added it was important to know one cannot solve all 17 of the problems highlighted by the UN's SDGs, but by focusing on a few, she said “we can hope to move the needle”.

simoney.kyriakou@ft.com

The House View from Schroders

How attitudes are shifting on sustainability

Numerous surveys have shown that demand for sustainable investment is on the rise, thanks in large part to millennials.

But the investment industry has been poor at clarifying what “sustainability” means and what is being offered to clients in practice.

Instead, ever more terms are being thrown into the ring: ethical exclusions, green investing, impact... The list goes on.

What do clients think?

At Schroders, our approach to product development is

client-led, so we polled 22,000 investors in 30 countries to find out what they wanted in a sustainable investment fund.

The results were interesting and encouraging.

The most popular response from clients was that “sustainable investing” meant investing in companies that are proactive in preparing their businesses for environmental and social changes that may affect them in the future.

Assessing the health of stakeholder relationships isn’t just about checking whether a company has a certain policy in place

This resonates with our philosophy as active fund managers: we have always thought of sustainability as the durability of a business’s growth and returns, i.e. “what makes a great company stay great?”

More than a box-ticking exercise

Needless to say, the answer can’t be distilled into a single metric or company rating.

Ultimately, we believe that only companies that are run for the long-term, taking account of their impact on all stakeholders, will be able to sustain strong growth and returns.

Assessing the health of stakeholder relationships isn’t just about checking whether a company has a certain policy in place.

VW, for instance, had a whistleblower policy, which didn’t prevent the ‘dieselgate’ emissions scandal. What is required is a full analysis of a company’s culture and operations.

It’s about, for example, whether they can attract, retain and motivate the best talent, or embrace innovation that will enable them to adapt to a changing world.

We believe many of the sustainability products on the market today are too narrowly focused on a tick-box approach to ESG (environmental, social and governance) at the expense of fundamental analysis.

Younger investors are the most engaged, so as their wealth grows it is important that sustainable investment products are available to meet demand

A “good” company – one that ticks all the ESG boxes – is not necessarily a good investment. It may not have strong growth prospects, a great competitive position, and returns above its cost of capital.

Alternatively, it may be a great business but with the positive characteristics already priced in by the market.

To our minds, this is why many mainstream ESG indices, which select companies based purely on ESG scores, have performed poorly.

It’s also why we don’t believe passive approaches are appropriate in this space.

We believe that consistently beating the market depends on combining in-depth sustainability analysis with rigorous fundamental research.

To this end, Schroders is taking a collaborative approach, combining the rigorous fundamental analysis and established investment process of our experienced Global Equities team with insight, research and experience from our Sustainability team.

Active ownership and ongoing engagement will also help to deliver long-term shareholder value: after all, there is no such thing as a perfect company.

Products must be fit for purpose

What is clear is that investors are more interested in sustainable investing than ever, with 78 per cent in our Global Investor Study stating that it has become more important to them over the past five years.

Younger investors are the most engaged, so as their wealth grows it is important that sustainable investment products are available to meet demand.

For products to be ‘fit for purpose’ they must be consistent with clients’ understanding of “sustainable investing”.

We believe that means investing in companies that are proactively positioning themselves for a rapidly changing world, and where we can deliver value by sharing in and helping to shape their future growth.

This is what we are seeking to achieve with the SISF Sustainable Growth Fund, a concentrated portfolio of companies we want to own for the long run.

Katherine Davidson is portfolio manager, global and international equities at Schroders